Prince Charles Cinema: Has London's "meanest landlord" met his match?

Plus: Scroll down to find out who is putting a helicopter storage facility in their south London garden, and a mysterious water contamination at the V&A.

There was an enormous response to last week’s London Centric investigation into Lime e-bikes breaking Londoners’ legs which asked whether the vehicles had a design flaw. It prompted a very lively and fascinating debate in the comments section, weighing up the benefits of making cycling accessible to more people (I personally remain a regular users of the bikes, albeit more gingerly) with Lime’s responsibility to ensure their product is safe.

London Centric’s inbox has since been flooded with leaked information from Lime employees (you can get in touch anonymously and in confidence here) about how the company’s operates, as well as messages from many more Lime riders who have been severely injured.

As a result, London Centric will have much, much more on this in the coming weeks — especially as yesterday the boss of Lime, which is getting ready for a multi-billion pound stock flotation and needs to avoid bad publicity, announced a further £20m investment in the capital, claimed that half of all young Londoners hire an e-bike once a week and said Lime had an enormous four million users in the capital.

Today’s main story is the tale behind something that has been taking over the social media feeds of many Londoners this week: the billionaire landlord accused of trying to “bully” the Prince Charles Cinema near Leicester Square out of a building he owns. Read on to find out how the same landlord is linked to a number of other intriguing London stories London Centric has covered, ranging from dubious Harry Potter shops to the closure of the UK’s first YMCA.

Scroll down to read today’s main piece.

If you want to support a new type of local journalism for the capital and receive member-only stories, please consider becoming a London Centric subscriber if you haven’t already done so. You can join for 25% off here — meaning a year’s subscription is just £59 — or test the waters before you buy with a free trial.

Exclusive: Water contamination at the Young V&A.

The Young V&A museum in Bethnal Green, east London, was closed last week following an unspecified “water contamination” incident that saw two staff hospitalised, reports Sarah Woolley. The museum also urged anyone who visited the museum last Thursday to “seek medical advice” if they felt unwell. The source of the contamination has not been made clear.

The London Ambulance Service told London Centric they were called to the site on Cambridge Heath Road at 1:21pm and arrived within two minutes. Two people were treated at the scene before one person was taken to hospital by ambulance and another by a third party. A London Fire Brigade spokesperson said its crews “carried out a sweep of the property to check for elevated readings of chemicals”. Young V&A closed its doors last Friday as a precautionary measure.

A V&A spokesperson said: “The safety and wellbeing of everyone who visits and works at Young V&A is our top priority… We took the decision to close on Friday 24 January as a precautionary measure to undertake final tests to be absolutely certain that it was safe to open, and reopened the following day with approval from all relevant authorities.”

Update: The V&A has been in touch to clarify the individuals hospitalised were staff, not visitors.

Preposterous London property of the week.

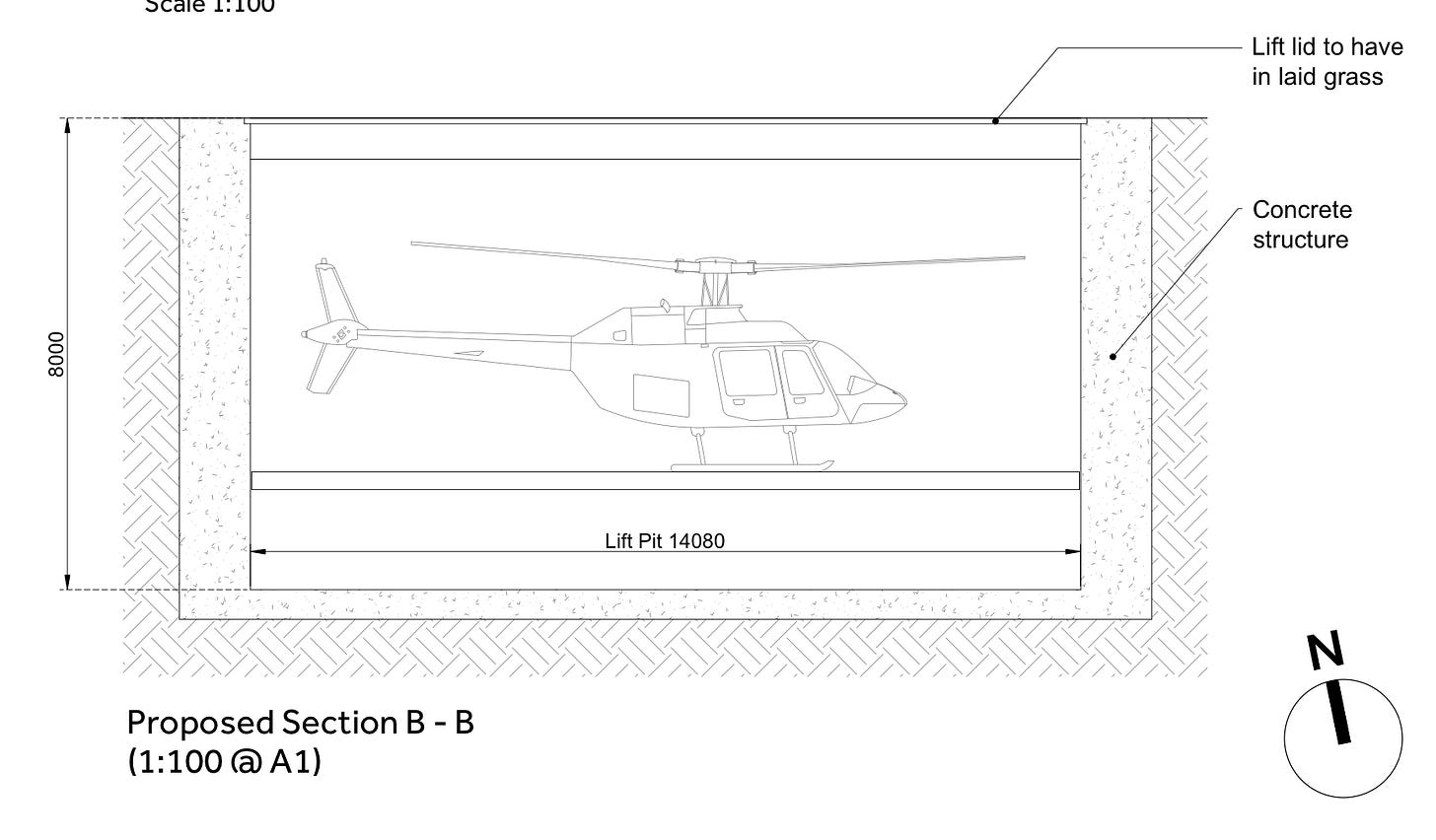

One resident of Chislehurst, south east London, has applied for permission to build an underground helicopter storage facility in his garden, as highlighted by Ian Visits. Diving deeper into the planning documents reveal that the application has been made on behalf of 30-year-old Matthew Benaron, chief executive of a management consultancy firm, who is proposing to build an eight-metre-deep concrete cocoon with a hydraulic lift.

The storage facility’s lid will be covered in grass and made flush with the rest of the lawn, with the helicopter rising up out of its Bond villain-esque lair when required. The planning application filed at Bromley council says the facility is necessary due to Benaron’s “need to regularly access and make use of a private aircraft” from the garden of the large suburban house, which was bought by his company for £4.4m in 2022: “The erection of a subterranean lift will ensure the applicant can locate their helicopter out of view, and in a more covered and protected location within the site.”

Sadly, Benaron did not pick up the phone when London Centric called to request a site visit — but we remain keen to have a look when it’s built.

London Centric’s person of interest: The billionaire landlord taking on the Prince Charles Cinema.

Regular readers of London Centric will be all too aware of the curiously interconnected webs of power, money and – perhaps inevitably – scandal that sit beneath the surface of the city. Behind this week’s social media storm over threats to the future of the much-loved Prince Charles Cinema is a man who has come across our radar on a surprising number of occasions in the last two months: the billionaire property developer Asif Aziz.

His family’s Criterion Capital business is one of London’s biggest and most intriguing property companies. It is the owner of the Trocadero building in Piccadilly, meaning the 58-year-old is the ultimate landlord of the unofficial Harry Potter merchandise shop unit we revealed in December has run up £400,000 in unpaid taxes to the local council.

That same month London Centric also reported on Criterion’s deeply controversial purchase of the world’s first YMCA branch on Tottenham Court Road. It believed Aziz intends to replace the community venue with an extension of his “affordable windowless hotel” chain Zedwell, which already has a branch, designed by his partner, in the building’s former underground car park.

And now Criterion has been accused of trying to “bully” the operators of the independent Prince Charles Cinema near Leicester Square, which operates in a building owned by one of Aziz’s businesses in the off-shore tax haven of the Isle of Man.

Rather than let the news of the rent dispute leak out, on Tuesday the Prince Charles Cinema brought a metaphorical gun to the fight and launched a surprise all-out media assault on Aziz. They accused his company of offering a new lease on terms that would make it impossible for the cinema, one of the few affordable places to watch a diverse selection of films in central London, to continue in business.

The enormous media attention will be deeply uncomfortable for Aziz. His company website boasts of Criterion’s role as “long-term custodians of the West End... deeply invested in protecting its rich heritage, preserving its character, and ensuring its enduring vitality” and he has delighted in the title of “Mr West End” for his ownership of property in central London. The row also harms his attempt to portray himself as a major cultural and philanthropic figure in the UK through his charitable Aziz Foundation, which funds staff who work in the offices of several Labour MPs.

Do you have something to tell London Centric about Asif Aziz? Get in touch anonymously and securely.

Crucially, with the Prince Charles Cinema, Aziz has made the mistake of taking on a rare thing: a business in the heart of the capital’s West End that resident Londoners, rather than tourists, care deeply about. Paul Mescal, the star of Gladiator, has urged his fans to support his "favourite cinema in London", while Hot Fuzz director Edgar Wright called it a “true church of film”. After hundreds of thousands of people signed a petition in support of the Prince Charles Cinema its operators thanked people for supporting a “a city that's worth living in” and for wanting “culture and community to exist”.

So who is Aziz, the man man dubbed Britain’s “meanest landlord” by the Sunday Times in 2020 after he demanded rent in full from hospitality businesses that had been forced to close due to the Covid pandemic?

“Can we not bullshit the numbers another way?”

Aziz’s origin story has been told in several ways; in some profiles the Malawi-born businessman began his career as a 16-year-old living in London who bought two flats in Deptford and converted the upper floors into residential properties. In others profiles the story is described as taking place on Brompton Road, in the far more glamorous environment of South Kensington.

Regardless, there is no doubt that the big break in Aziz’s life happened when he moved from London to Angola in the early 1990s, during the southern African country’s bloody civil war. Still in his mid-20s, he ran Golfrate, a food manufacturing and consumer goods distribution business in a country that was equally blessed and cursed by its enormous wealth from oil and diamonds. Court documents from both the English and Isle of Man court systems reviewed by London Centric describe Golfrate as a “cash-and-carry” business controlled by Aziz which sold “food, home and personal care products”, including through an exclusive distribution deal with Nestlé. In a sign of his important status in war-torn Angola, Aziz acted as an honorary consul of the Malawian government.

Aziz ultimately sold the Angolan business to a rival for around $20m in 2005, setting off a vicious long-running legal dispute with its new owners over whether the company had been accurately valued. A legal case from that era, strongly disputed by Aziz, accused him of over-inflating the Angolan company’s financial performance and charging excessive expenses. One document quoted an email allegedly sent by Aziz to his accountant, asking: “Will they check each figure — can we not bullshit the numbers another way? Food for thought.”

(Aziz has said the case was ultimately settled with the other side paying his legal costs. The new owner of Aziz’s Angolan businesses, who made the disputed accusations, was later sanctioned by the US government for allegedly being a major fundraiser for the Iran-backed Islamist organisation Hezbollah.)

“Ruthless and clever landowner”

Having cashed out in Africa, Aziz moved back to London and quickly began investing heavily in property across the capital, both through subsidiaries of Golfrate and then the newly-formed Criterion Capital, named after the Criterion building he bought in the West End. In 2005, aided by the money from the sale of the Angolan import business, his company spent £200m buying the Trocadero, a down-at-heel entertainment complex by Piccadilly Circus that housed FunLand, the arcade computer game complex once known as SegaWorld.

Other purchases the across the West End followed, as well as less glamorous sites such as The Fridge nightclub in Brixton (now The Electric) and private car parks in south London, where clampers were accused of heavy-handed tactics. His company’s true financial performance and accounts are obscured behind a web of off-shore companies based in the tax haven of the Isle of Man. But by the eve of the financial crisis in 2007 the Sunday Times Rich List was already estimating his family’s net worth at around £140m.

The speed of Aziz’s rise on the London property scene was unusual and his methods brought him unwanted publicity from Mitcham and Morden MP Siobhan McDonagh. In 2011 she stood up in the House of Commons and described at length her constituents’ exasperation with the “very unpopular” Aziz, who had bought a large concrete tower in her constituency then neglected it for years. McDonagh alleged that whenever she and the local council attempted to force Aziz to clear up the site, the “ruthless and clever landowner” would ignore their demands.

“Because the company is well financed, can afford good lawyers and its site is worth millions of pounds, we cannot take it on,” she told parliament. “All we really want from Mr Aziz is for him to be a good neighbour — although if we are relying on people like him to behave decently of their own accord, we might have a very long wait.”

Aziz hit the headlines again in 2017 after a divorce case with his former Angolan-Portuguese wife Tagilde Aziz in the high court, where she sought half of a fortune then valued at £1.1bn. His lawyers argued Tagilde deserved nothing as their marriage was never legal, saying it was based on a 2002 Muslim ceremony in Malawi which only took place to ensure they had the paperwork to take their adopted child back to London from Africa. Her lawyers, in turn, argued that Asif was playing down the size of his fortune. The parties eventually settled out of court, and the details were never made public.

Neither the high-profile divorce, nor the parliamentary criticism derailed Aziz, who has a home in Wimbledon but is now spending an increasing amount of time in Abu Dhabi.

Criterion continued to grow and now claims to have $9 billion (£7 billion) of investments “deployed” across 58 properties with more than 1,000 employees. Ongoing developments in the capital range from the redevelopment of a major site around Dalston’s Kingsland Road shopping centre, to a massive housing development near Morden Wharf on the Greenwich Peninsula. Criterion’s website boasts that as “a family business built on family values” the company takes “immense pride in the connections we foster and the communities we serve” but — according to the journalist John Lubbock — Aziz’s businesses are linked to a number of pub closures across suburban London.

The businessman has also increased his philanthropic activity, bringing him close to some of the most powerful people in the country: Aziz paid for central London’s first Ramadan lights display, appearing alongside mayor of London Sadiq Khan at last year’s launch. He also subsidises young Muslims to attend university and received Islamophobic abuse after announcing plans to build a large central London prayer room in his Trocadero building. Several Labour MPs have office interns subsidised by Aziz’s foundation.

But it is the high-profile battle over the future of the Prince Charles Cinema that may cause Londoners to finally join the dots and realise how powerful Criterion — and Aziz — has really become in the capital. The building housing the cinema, a site in one of the busiest tourist spots in London with lucrative potential, was bought for £13m in November 2022. The venue claims Criterion is threatening it with a large rent increase, plus a six month notice period for potential redevelopment, which would leave a constant threat of eviction over its head.

In a rare public statement, Criterion insisted it is following standard legal practice in rent negotiations with the Prince Charles Cinema and its proposed terms for a new lease from September reflected market conditions. Criterion also warned its tenant against carrying out a public relations battle through the media: “We are committed to curating a portfolio that balances community benefit with sustainable commercial arrangements, and mischaracterising our position through public campaigns hinders resolution.”

“I will continue to make mistakes until the day I die”

Although he owns so many of central London’s prominent buildings, the exact ownership structure of Aziz’s companies is often obscured by off-shore registrations, with his name sometimes missing from official filings of companies connected to him.

Despite this, documents analysed by London Centric suggest Aziz’s companies control much of Leicester Square. This includes the Odeon Leicester Square cinema — host to many premieres, including for this week’s new Bridget Jones film — which was bought for £84m in 2018 by an Isle of Man business closely connected to Criterion. The Odeon, a chain-branded cinema charging some of the highest ticket prices in the West End for new releases, could not be more different to the eccentric feel of the Prince Charles Cinema around the corner, beloved for its screenings that range from cult arthouse classics to Solve-Along screenings of Murder She Wrote. But — in one of those hidden connections that run throughout the capital — both cinema operators appear to be paying their rent to the same man’s business empire.

The West End is full of corporate outlets and bland tourist shops used daily by millions of people who, understandably, don’t have the time to engage with the complex ownership structures behind them, or ponder where their money ultimately flows. But the Prince Charles Cinema is a place people feel a sense of ownership over, thanks to the authenticity of its cheap ticket prices and carefully-curated events programme. And it’s not struggling under the existing lease – its current operators say 2024 was a record year with over a quarter of a million tickets sold.

Aziz and his companies did not respond to a request for comment from London Centric. According to a recent glowing profile written by Professional Wealth Management, he has “never been worried about people’s perceptions” because “you can never make everyone happy”.

“The greatest lesson I've learned is that I will continue to make mistakes until the day I die, and I continue to persevere,” he told the publication.

Yet the man who bought much of the West End may have met his match in a community of cinema-lovers who say they are willing to persevere all the way through the courts and fight for a “truly irreplaceable” venue.

Ben Freedman, the operator of the Prince Charles Cinema, warned of what would be lost if his cinema closed: ”It would mean losing not just an iconic cultural institution, but also an engine for the economy of the West End that brings people from all over London and the surrounding area to watch films, shop and eat and drink. This would have repercussions way beyond the building itself. We can’t let that happen.”

Did you enjoy this edition of London Centric? Please forward it to a friend, get in touch via email or WhatsApp., or leave a comment.

I'm aware there's a lot in this already and some things just couldn't make it for space — but I was amused to realise that mega media company Global, owner of London radio stations Capital and LBC, is also a tenant of one of Mr Asif's — one of his companies bought the freehold of their headquarters on Leicester Square in 2018.

I've met Aziz at one of his schmoozing, 'awareness raising' events to try and keep the Soho natives happy about the threat to our primary school. When I spoke to him about the real reason for the threatened closure of Soho Parish School ie: fewer children as nobody could afford the rent anymore; the lack of affordable housing hollowing out the West End, he became self-contradictory, clammed up and then palmed me off onto his wife for small talk. He then retreated to his brown-nosing buddies. He's an insecure bully.